Introduction: Understanding Business Organization Forms:

There Are Many Different Types Of Commercial Organizations In The World Of Business, And Each Has Special Traits, Benefits, And Drawbacks. Which Is A Better Option In Terms Of Liability, Governance, Taxation, And Operational Flexibility—A Corporation, Partnership, Sole Proprietorship, Or Cooperative? We Will Examine The Many Types Of Business Organization In This In-Depth Course, Going Over Their Features, Appropriateness For Particular Projects, And Factors To Take Into Account When Selecting A Business Structure.

Personal Property:

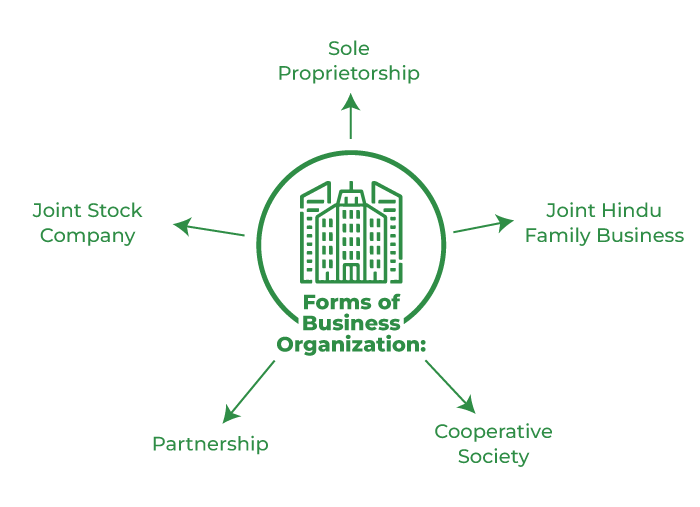

An organization engaged in some commercial activity or business with the motive of earning profit is known as a business enterprise. If an individual or a group of individuals plans to start a new business or expand its existing business, selecting the right form of business organization is essential for them. There are five different forms of business organization from which one can select the best option for them. These are Sole Proprietorship, Joint Hindu Family Business, Partnership, Cooperative Societies and Joint Stock Companies. For selecting the most appropriate form of business organization, one has to weigh every merit and demerit of each form of an organization against their requirements.

Forms of Business Organization:

Sole Proprietorship:

A popular form of business organization in which the business is owned, managed, and controlled by an individual is known as a sole proprietorship. This individual is the recipient of every profit and loss of the business and bears every risk coming to the business. Here, the word sole means only and proprietor means owner; hence, the only owner of the business. Usually, businesses with personalized services like hair salons, beauty parlours, retail shops, etc., run under sole proprietorship. In this form of business, the owner is not separate from the business; hence, no separate legal entity. Besides, the owner does not have to perform any legal formality and can start the business whenever they want.

Joint Hindu Family Business:

A form of business organization found only in India in which the business is owned and carried on by the HUF(Hindu Undivided Family) members is known as Joint Hindu Family Business. It is one of the oldest forms of business organization in India. This form is governed by the ‘Hindu Law’. The eldest member and head of the family, also known as “Karta,” controls the business. Membership in this form of business organization is based on the birth in a specific family. The three successive members of the family can be the members of the business. Every member of the business have equal right and ownership over their ancestor’s property, and these members are known as ‘co-parceners.’ The two conditions for the existence of a Joint Hindu Family Business are: there must be some ancestral property, and a minimum of two male members must be in the family.

Explanation:

The Most Basic Type Of Business Structure Is A Sole Proprietorship, In Which One Person Owns And Runs The Company. The Proprietor Of The Company Retains Total Authority Over The Business And Takes On All Related Obligations And Liabilities.

Characteristics:

• Exclusive Management And Ownership.

• Unrestricted Responsibility And Debt Liability.

• Slightly More Stringent Regulations.

• Taxed As The Owner’s Personal Income.

Collaboration:

Explanation:

In A Partnership, Two Or More People Own, Manage, And Take On The Financial And Legal Obligations Of The Business Together. The Three Types Of Partnerships Are General, Limited, And Limited Liability Partnerships (Llps).

Qualities:

• Distributed Management And Ownership Duties.

• Consent Between Parties Via A Partnership Agreement.

• Liability For Partners May Be Restricted Or Unrestricted.

• Distribution Of Gains And Losses Occurs Among In Accordance With The Terms Of The Cooperation Agreement.

• The Kind Of Partnership Affects The Taxation.

Business:

Explained:

A Corporation And The People Who Control The Company’s Shares Are Two Different Legal Entities. Companies Are Given Certain Legal Rights And Obligations, Such As The Capacity To Sign Contracts, Bring Legal Action, And Be Sued.

Features:

• A Distinct Legal Entity With Restricted Stockholder Liability.

• Management That Is Centralized Under A Board Of Directors.

· The Ability To Raise Money By Issuing Bonds And Stocks.

• Difficult Regulatory Procedures And Requirements.

• Taxing Business Profits And Dividends Twice.

Corporation With Limited Liability (Llc):

Explained:

In Order To Provide Members With Limited Liability Protection And Flexibility In Taxation And Administration, Limited Liability Companies (Llcs) Combine Aspects Of Corporations And Partnerships.

Characteristics:

• Members’ Limited Liability Protection.

• Modular Organizational Framework.

• Pass-Through Taxes, In Which Each Member’s Individual Tax Return Contains A Disclosure Of Profits And Losses.

• Requirements For Regulations And Procedures Are Lower Than For Companies.

Collaborative:

Explanation:

A Cooperative Is A Business That Is Owned And Operated By Its Members, Who Have Common Goals Or Interests. Cooperatives Are Frequently Established To Supply Their Members Or The Community With Goods Or Services.

Features:

• Democratic Membership Ownership And Control.

• Decision-Making And Earnings Sharing.

• In Certain Cooperative Forms, Members’ Responsibility Is Restricted.

• A Focus On Social Responsibility, Community, And Cooperation.

Things To Take Into Account While Selecting A Business Organization:

Accountability:

Think About How Much Personal Liability You Are Willing To Accept To Consent To. Limited Liability Protection Is Provided By Corporations And Llcs, While Less Protection From Personal Liability Is Provided By Partnerships And Sole Proprietorships.

Income Taxation:

Analyze The Effects Of Each Business Structure On Taxes. While Corporations May Pay Double Taxation On Profits And Dividends, Partnerships And Sole Proprietorships Are Subject To Personal Income Tax.

Oversight And Direction:

Determine The Ideal Degree Of Management Structure And Control For The Company. Whereas Corporations Have A Board Of Directors Supervising Administration, Sole Proprietors Have Complete Control.

Capital Requirements:

Take Into Account Both The Company’s Finance Requirements And Its Chances Of Raising Money. Companies Can Raise Money By Issuing Bonds And Stocks, But Partnerships And Sole Proprietorships Rely On Loans And Personal Savings.

Conclusion: Selecting The Appropriate Organizational Framework:

Selecting A Business Organization Is A Crucial Choice That Has A Big Impact On A Company’s Operations And Performance. Through Comprehension Of The Attributes, Benefits, And Drawbacks Of Every Type Of Business Structure, Entrepreneurs May Make Informed Judgments That Correspond With Their Inclinations, Aspirations, And Future Targets. Potential Business Owners Should Take Into Account The Unique Opportunities And Challenges Presented By Each Type Of Business Structure, Such As The Ease Of Use Of A Sole Proprietorship, The Adaptability Of A Partnership, The Liability Protection Of A Corporation, Or The To Succeed, A Cooperative Must Overcome Its Cooperative Spirit.